Viettonkin Consulting has been trusted by hundreds of entrepreneurs and corporations overseas for over 15 years to set-up businesses in Vietnam.

We offer:

-

Business Incorporation

-

Cooperate Secretarial Services

-

Compliance Services (Legal, Tax and Accounting)

-

Corporate Banking Services

-

Nominee Services

-

Administrative Services

-

Human Resource (HR) recruitment and management

-

Global Payroll & Mobility

Vietnam has actively introduced and amended policies to allow for full-foreign ownership in most industries.

Company incorporation in Vietnam involves a series of intricate legal procedures. Investors must comply with local regulations and make informed decisions about business structures.

-

There are various entity types to choose from, such as limited liability companies, joint-stock companies, or partnerships, each with its own set of advantages and requirements.

-

Three of the most common structures are the Representative Office, Branch Office, and 100% Foreign-Owned Limited Liability Company (LLC).

-

An LLC typically requires 3 to 4 months to establish. Representative Offices can often be set up in half the time, around 2 months. Meanwhile, Branch Offices generally require 3 months for setup.

-

The registration process entails document preparation, submission, and interaction with Vietnamese authorities.

-

As most entities require a resident director to be appointed, Viettonkin provides nominee service to assist in this.

Viettonkin Consulting offers a full-service package for complete business incorporation and creates a streamlined and efficient process for foreign investors. We assists investors in managing the complex registration process, selecting suitable entity types, and ensuring full compliance with local regulations.

Full-Service Company Set-up Package

-

Company Incorporation: Provide expert guidance in selecting business locations, conduction market assessments, identifying the optimal business structure for clients and handle the document preparation to be submited to relevant authorities for business registration.

-

Corporate Secretariat Services: Develop detailed work plans, track schedules, and provide reminders. We will also handle meeting logistics and assist with venue selection and management for registered locations as well as research and update clients on relevant legal documents and changes.

-

Compliance Services: Assist with the drafting, finalization, and submission of required periodic reports to regulatory authorities and handle applications for any additional licenses required throughout the enterprise's operations.

-

Corporate Banking Services: Collaborate with banks on behalf of our clients for matters related to opening or closing accounts, updating account information, and facilitating money transfers.

-

Tax Advisory Services: Advise companies on a wide range of domestic and international tax issues, including understanding their global effective tax rate, assessing tax impacts of business restructuring, and preparing for new and upcoming regulations. We help companies implement effective strategies to manage tax obligations and increase earnings, and cash flow.

-

Additional Services: Offer Nominee Services, Administrative Services, Legal Services, Human Resource Management and Accounting & Tax

Limited Liability Company (LLC)

- 100% Foreign-owned Enterprise

- An LLC has its own charter and board of members (BOM)

- Members of LLC are responsible for the liabilities of the company to the extent of the amount of capital the member has contributed

- LLC is also authorized to establish independent units like branches and representative offices domestically or abroad

- LLC does not issue shares

Minimum Capital: No requirements for most sectors but typically, it would be at USD 10,000 or above. However, some industries like Finance, Banking, Insurance, Language Centers and Real Estate Companies) do have requirements.

Ownership: Single-Member LLC with one owner and Multiple-Member LLC with more than one stakeholders.

Set-up Time: 12-16 weeks

Viettonkin's Suggestion: One of the most common business entity and recommended for most cases. Liability is restricted to captial contribution and have great freedom and flexibility in conducting business operations.

Joint-Stock Company (JSC)

- A limited liability entity formed by the subscription for shares in the company

- Only type of business entity that can issue shares under Vietnam legislation

- Members of JSC are responsible for the liabilities of the company to the extent of the amount of capital the member has contributed

Minimum Capital: Approximately USD 475,000 to be publically listed

Ownership: Required to have at least 3 shareholders (no cap on the number of shareholders maximum)

Set-up Time: 8 weeks

Viettonkin's Suggestion: Recommended if the company needs to acquire large capital. Otherwise, LLC would suffice.

Joint Venture

- Created by two or more parties and generally characterized by shared ownership, returns, and governance.

- Required by some business industries, including but not limited to: Advertising, Agriculture & Forestry, Transportation, Electronic Games, Telecommunication, Travel & Tour, Container Handling

Minimum Captial: No requirements for most sectors but typically, it would be at USD 10,000 or above. However, some industries do have requirements.

Ownership: In most sections, foreign investors must contribute at least 30%. Some industries are considered sensitive by the government and limit foreign ownership. For example, the limit for goods transportation by rail or domestic waterway is 49%

Set-up Time: 12 weeks

Viettonkin's Suggestion: Allows investment access to certain restricted sectors which require local ownership.

Representative Office

- Representative office is a dependent unit of an enterprise, established in accordance with the laws of Vietnam.

- Main purpose of a representative office is to maintain the liaison, assist the enterprise in approaching business partners in Vietnam, conduct market researches, and promotion of business.

- May not conduct any other profitable business and does not have the right to sign a separate contract on its own.

- The parent company bears all financial obligations arising from the operations of the Representative Office, so the accounting of the RO is dependent on the enterprise.

- Must operate for at least 1 year in original country.

- A Representative Office license is valid for five years but can be extended for another five years.

Minimum Capital: None, but it would be prudent to ensure sufficient funds for operations.

Ownership: -

Set-up Time: 8 weeks

Viettonkin's Suggestion: Low-cost entry option to help foreign companies research and gain insight into the market, paving way for a larger market entry in the future.

Branch Office

- Similar to RO but can partake in some revenue-generating activities under certain restrictions defined by parent company.

- BOs have the freedom to: Enter and amend contracts or agreements, set up accounting departments independently, hire staff, purchase and sell goods and services per licensing, and many more.

- Parent company is fully liable for all activities of the branch.

Minimum Capital: None, but require establishment license and have a seal with the parent company name

Ownership: Requires a branch manager who is a Vietnamese Resident

Set-up Time: 12 weeks

Viettonkin's Suggestion: Not recommended as other business structure are more worth-while in terms of licensing complexity and freedom of activies. However, Viettonkin can assist in easing the process if required.

In some countries like Vietnam, having a resident director is a legal requirement for entrepreneurs incorporating a new limited liability company.

The resident director must be a local citizen or a foreign national with a valid residency permit, possessing a local address and currently living in the country

How can Viettonkin Assist?

Our nominee services provide confidentiality and operational support for companies aiming to protect their identities and ensure compliance, particularly valuable for businesses entering new geographic markets. Through the services, a third-party entity will be appointed as a representative, allowing the actual owner’s identity to remain private. It can be very useful for businesses to maintain discretion or comply with local requirements without revealing ultimate ownership.

Services Provided

- Our nominee services include professional directors and shareholders, selected for their clear and trustworthy backgrounds at the client’s request. These representatives are legally appointed to act on behalf of clients in company operations, ensuring compliance and privacy.

- We meticulously draft contracts and security measures to safeguard the representation process, securing the client’s interests.

- We also take full responsibility for all representative activities related to the client's company, ensuring transparency and trust in all operations conducted on behalf of the client.

Setting up a business in a foreign country is challenging, especially considering the complex and intrigate regulations that differs from country to country.

Significant time and effort are required to comprehend and overcome these variances: researching the target country and its people, fulfilling the legal requirements like licensing and accreditation standards, company registration, seeking the ideal location, assembling the assets, or finding the right and trustworthy talents. This problem is exacerbated if there is a difference in language and culture.

Time is a valuable asset of all businessmen, hence it is crucial to engage a professional partner who understands the local regulations and the culture in ASEAN. Backed by years of experience and trusted by thousands of enterprises abroad, Viettonkin Consulting is in a good position to facilitate your foreign direct investments and company registration in key markets. We provide the full range of company incorporation services and beyond that simplifies the process for you and alleviate your burden:

Step 1: Pre-Incorporation

After signing the engagement letter, we will organize a meeting with the client to discuss the direction going forward. Viettonkin Consulting will prepare a tailored report based on the client's needs on these following considerations:

- Type of entity

- Company name

- Location of headquarters

- Legal industry to register

- Authorized captial for the client's business

- Title for company's representative in law

Afterwards, we would draft a comprehensive project plan that details all the steps and the timeline involved.

Step 2: IRC and ERC

Viettonkin Consulting will assist the client to prepare a dossier of necessary documents, including bylaws and Power of Attorney, which will be signed and attested by the client. The documents will be submitted to the Department of Planning and Investment and the Business Registration Office.

The two most important certificates that international investors must obtain are the Investment Registration Certificate (IRC) and Enterprise Registration Certificate (ERC). The IRC application usually takes 30-45 days, while for ERC, it will typically be 10-15 days.

Step 3: Company Seal

Following approval, a company seal is obtained, allowing the company to register with the tax department, open a bank account and proceed with operations.

Step 4: Tax Registration

After receiving the seal, we will guide the company to apply for a tax code and obtain pre-printed VAT invoices.

Step 5: Corporate Banking Services

We will collaborate with banks on behalf of our clients for matters related to opening or closing accounts, updating account information, and facilitating money transfers.

Step 6: Company Secretarial Services

Running a business is no easy task. We aim to lessen the client's burden by helping to oversee and manage all activities involved throughout the corporate secretary acquisition process, including the preparation of all documents related to capital contributions and share allocations.

We will develop detailed work plans, track schedules, and provide reminders. We will also handle meeting logistics, assist with venue selection and management for registered locations, as well as research and update clients on relevant legal documents and changes.

If need be, we will assist the client to submit applications for any additional licenses required throughout the enterprise's operations.

Step 7: Human Resource Management

We will support our clients' recruiting strategies to attract the best talent.

At the same time, we shall support our clients with applying for approval of labor demand, applying for Work Permit/Work Permit Exemption, VISA, health check, and police clearance certificate.

Step 8: Administrative Services

To maximize the efficiency of business operations, we will organize and maintain the company’s internal documents.

We will also translate documents between Vietnamese and English, manage copies, and facilitate notarization of business documents at appropriate agencies.

Documents Required

While the documents required for incorporation might vary, these are the common documents in which the company should prepare:

- For foreign shareholders and directors: Passport copies, proof of address, and bank statement.

- Certificate of Incorporation

- In-principal lease agreement

- Corporate shareholder documents and proof of funds for share capital

- Power of Attorney authorizing the Vietnamese legal representative

Documents must be notarized and legalized in the client's home country if submitted from overseas. Translations into Vietnamese are required for certain documents.

To attract more foreign investment and foster competition, Vietnam offers tax incentives and leasing benefits in designated areas called Economic Zones.

In addition to Economic Zones, Vietnam also possesses Industrial Parks, Export Processing Zones and High-Tech Zones. Foreign investors can leverage on these free zones to grow their business at a lower cost. As of 2024, Vietnam has 44 economic zones, 563 Industrial Parks, and 4 Export Processing Zones.

Benefits

- Preferential CIT of 10% for a maximum of 15 years

- Preferential CIT of 10% for a maximum of 30 years for High-Tech Projects

- Preferential CIT of 10% for the duration of the operational period for education and training, occupational training, healthcare, culture, sport, and environment businesses

- Preferential CIT of 15%/17% for certain projects like farming, breeding, agricultural and aquaculture products processing businesses, and more

- CIT incentives available for large manufacturing projects with an investment capital of US$258,000 (6,000 billion VND) or more and minimum annual revenue of US$430,620,000 (10,000 billion VND) for at least three years after the first year of operations, or with at least 3,000 employees after three years of operation

- Reduction of PIT by 50% for foreign and local employees

- VAT and Excise Tax exempted for imported, manufactured, or processed goods within the industrial zones

- Tax holiday for raw materials imported for manufacturing in Vietnam industrial zones

- Reduced or zero tariffs for goods traded within ASEAN

- Eligible for land rental fee exemptions

- 100% foreign ownership companies

- Modern infrastructure with extensive networks, including roads, ports, and airports

Industrial Zones

Vietnam free zones

|

Overview

|

Vietnam has a massive network of more than 250 industrial and export processing zones. The major zones are i) the Northern Vietnam Key Economic Region ii) Southern Key Economic Zone iii) Central Vietnam Key Economic Region and iv) Mekong River Delta Economic Zone. Each zone specialises in different sectors.

|

|

Advantages of setting up in a Vietnam free zone

|

Vietnamese free zones offer a wide range of tax benefits:

-

A 10% reduction in corporate income tax for up to 15 years for all projects.

-

A 10% reduction in corporate income tax for up to 30 years for high-tech projects.

-

A 10% reduction in corporate income tax for social projects such as health and education for the life of the project.

-

100% corporate income tax exemption for up to four years for approved projects, followed by a 50% corporate income tax reduction for up to nine years once the initial four-year exemption is complete.

-

A five-year exemption on import duties on raw materials for manufacturing.

-

A 50% reduction in personal income tax for both local and foreign employees.

-

Industrial Zone companies benefit from reduced or zero tariffs on goods traded within ASEAN (of which Vietnam is a member).

-

Manufacturers are exempt from paying import duties on raw materials for up to five years after production starts.

-

Manufacturers are also exempt from VAT and excise tax for goods processed or manufactured within an Industrial Zone.

-

Low labor costs compared with other Asian countries. Vietnam’s current minimum wage ranges from US$96–US$138 per month.

|

|

Major industrial zones in Vietnam

|

Vietnam Singapore Industrial Park (VSIP)

-

VSIP has projects located in Southern (Bac Ninh, Hai Phong) and Northern (Binh Duong) Vietnam.

-

Specialises in i) automotive components ii) electronics iii) pharmaceuticals and iv) consumer goods.

Phuoc Dong Industrial Park (PDIP)

-

Specialises in i) logistics and supporting services ii) bio-fuel iii) construction materials iv) steel components and v) textiles.

Hiep Phuoc Industrial Park (HPIP)

-

Specialises in i) leather processing ii) building materials iii) mechanics and iv) chemicals.

Dinh Vu - Cat Hai Economic Zone

-

Specialises in i) electronics ii) telecommunications iii) machinery iv) electrical and science equipment and v) chemical industries.

|

Major industrial zones in Vietnam 2024

|

Industrial Parks

|

Province

|

Size

|

|

Deep C IP

|

Hai Phong and Bac Ninh (Northern)

|

-

Scale: 3,400 hectares

-

Total leasing area: 3,400 hectares

-

Electronic components, automotive, chemicals, renewable energy equipment, logistics, mechanical engineering, food, packaging, and many others.

|

|

Nam Dinh Vu IP

|

Hai Phong (Northern)

|

-

Scale: 1,329 hectares

-

Total leasing area: 917 hectares

-

an industrial complex with integrated supply chains and seamless production across various sectors; including mechanical engineering, manufacturing of new materials, electrical equipment, electronic components, computer components, logistics and warehousing, support industries, and light industries.

|

|

Yen Phong II IP

|

Bac Ninh (Northern)

|

-

Scale: 1,200 hectares

-

Total leasing area: 644 hectares

-

high-tech industrial park

-

primarily in processing and manufacturing industries; high-tech and non-polluting technology industries; electronic assembly, precision engineering; and the automotive industry…

|

|

Amata Song Khoai IP

|

Quang Ninh (Northern)

|

-

Scale: 714 hectares

-

Total leasing area: hectares

|

|

Yen Binh IP

|

Thai Nguyen (Northern)

|

-

Scale: 693 hectares

-

Total leasing area: 400 hectares

-

high-tech and clean industries, such as the production of semiconductor electronic components and automation equipment.

|

|

Becamex Binh Dinh IP

|

Binh Dinh (Central region)

|

-

Scale: 1,425 hectares

-

Total leasing area: 1,000 hectares

-

industrial manufacturing sector

|

|

Nhon Hoi A IP

|

Binh Dinh (Central region)

|

-

Scale: 630 hectares

-

Total leasing area: 380 hectares

-

pharmaceuticals, food processing, agro-forestry-fishery processing, high technology, textiles, motorbike and automobile assembly, plastics, and various other supporting industries.

|

|

Lam Son Sao Vang IP

|

Thanh Hoa (Central region)

|

-

Scale: 537.3 hectares

-

Total leasing area: 227 hectares

-

high-tech food processing, aircraft maintenance, repair and operation, electronic equipment manufacturing and assembly, household appliance manufacturing, automotive parts, and transportation equipment, along with some other industries.

|

|

Du Long IP

|

Ninh Thuan (Central region)

|

-

Scale: 407.28 hectares

-

Total leasing area: 306.11 hectares

-

processing raw materials and material handling, such as wool scouring, yarn spinning, fabric weaving, etc.,

|

|

Phu Tai IP

|

Quy Nhơn (Central region)

|

-

Scale: 345.8 hectares

-

Total leasing area: 242.76 hectares

-

agricultural and forestry product processing, paint, stone, rubber, packaging, warehousing, building materials, footwear, mechanics, and several other industries.

|

|

Sonadezi Chau Duc IP

|

Ba Ria Vung Tau (Southern)

|

-

Scale: 2,287 hectares

-

Total leasing area: 1,556.14 hectares

-

Taiwanese sportswear and garment manufacturing plants, Korean raw material and energy production projects, and diverse ventures from various other countries.

|

|

My Phuoc 3 IP

|

Binh Duong (Southern)

|

-

Scale: 2,280 hectares

-

Total leasing area: 655.59 hectares

-

electronics, household appliances; automobile and motorcycle manufacturing and assembly; garment production, and food processing.

|

|

Phuoc Dong IP

|

Tay Ninh (Southern)

|

-

Scale: 2,191.97 hectares

-

Total leasing area: 338 hectares

-

electronics, household appliances; automobile and motorcycle manufacturing and assembly; garment production, and food processing.

|

|

Becamex Binh Phuoc IP

|

Binh Phuoc (Southern)

|

-

Scale: 1,993 hectares

-

Total leasing area: 1,993 hectares

-

electrical appliances, electronics, informatics, information technology, and the processing of food, agricultural, and forestry products

|

|

Hiep Phuoc IP

|

Dong Nai (Southern)

|

-

Scale: 1,686 hectares

-

Total leasing area: 597 hectares

-

21% for the mechanical manufacturing and telecommunications electronics industry, 11% for construction material production, and 10% for the food processing industry, along with other sectors such as paper, plastics, chemicals, pharmaceuticals, ports, and logistics.

|

Indonesia Special Economic Zones

|

Overview

|

Indonesia operates a network of 15 Special Economic Zones (SEZs) across the country. These zones seek to attract investments in sectors such as i) manufacturing ii) agriculture iii) natural resources and iv) tourism.

|

|

Advantages of setting up in a Indonesia Special Economic Zones

|

A wide range of tax benefits:

-

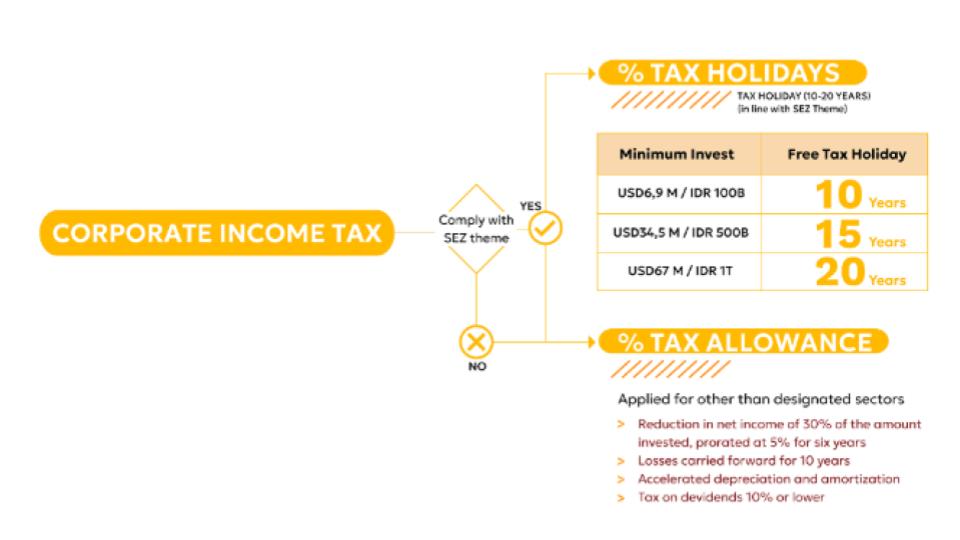

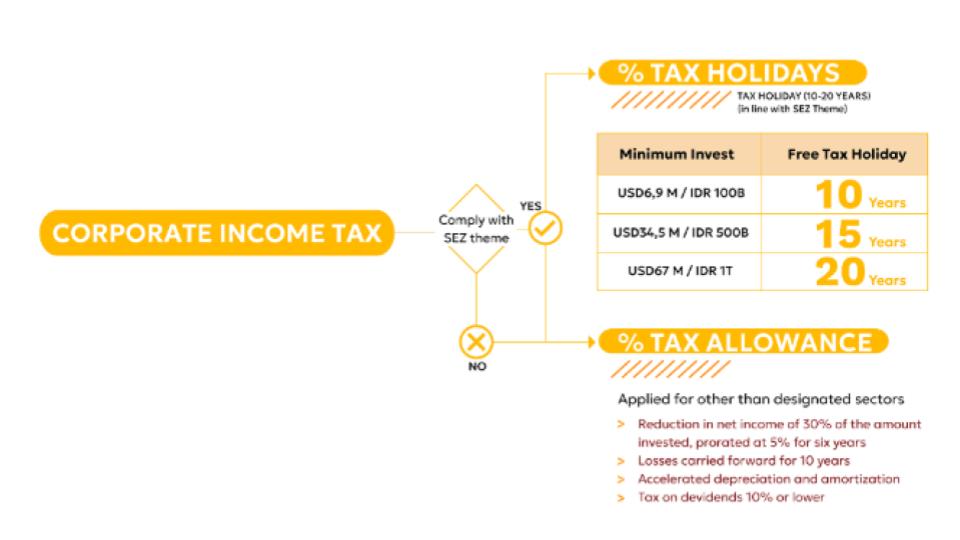

Companies investing at least IDR 100 billion (US$6.9 million) over a period of 10 years pay zero corporate income tax in an SEZ.

-

Investments exceeding IDR 20 trillion (US$1.41 billion) are eligible for a 20-year corporate tax break.

-

All other SEZ companies who are not eligible for tax breaks pay 22% corporate tax.

-

Tax Holiday: Applies to income received or obtained from main activities carried out in SEZs.

-

Tax Allowance applies to activities outside the main activities of the SEZ.

-

VAT or VAT and Luxury Goods Tax are not levied on the delivery of certain Tangible Taxable Goods from TLDDPs, free zones, and bonded stockpiles to Business Entities and/or Business Actors; import of certain Tangible Taxable Goods into SEZs by Business Entities and/or Business Actors; import of Consumer Goods into tourism SEZs by Business Entities and/or Business Actors; etc

-

Import Duty Exemption in the context of the development or development of SEZs.

-

For SEZs that have completed the construction and development stages, import duties are exempted for Consumer Goods and there is a suspension of Import Duty for business fields in SEZs

-

For the purpose of supervision, part or all of the SEZ can be designated as a Customs Area

-

No Tax in the Context of Import on the Import of Capital Goods in the Context of the Development or Development of SEZs

-

For SEZs that have completed the construction and development stage, Import Tax is not collected.

Other benefits:

-

It is exempt from paying duty on machinery and raw materials for the first two years.

-

0% Import Duty rate (minimum TKDN 40%). Goods subject to import and export conditions may be granted exemptions and/or relaxations.

-

Though SEZs have a minimum investment threshold of IDR10 billion (US$690,000), excluding land and buildings, tech start-ups are exempt from this commitment.

-

The SEZ company structure allows for 100% foreign ownership. A local Indonesian shareholder is not needed.

-

An Indonesian SEZ company can access a network of double tax treaties.

|

|

Distribution

|

SEZ distribution in Indonesia: please check the link:

https://kek.go.id/id/investment/distribution

|

Thailand free zones

|

Overview

|

Thailand's Free Zone Scheme looks to encourage firms to conduct manufacturing operations within the country's borders, with finished goods able to be used both domestically and for export. Foreign-based firms can set up in one of these locations to take advantage of generous incentives.

-

The primary type of Free Zone for foreign companies are the Special Economic Zones (SEZ). These offer benefits such as exemptions from import duties and VAT on imported products, as well as corporate tax holidays. They are intended mainly for export activities, and as such are typically found near the country's borders and biggest ports of entry and exit.

-

The second type of Free Zone is Industrial Estates. As the name suggests, these are focused on industrial activities, with companies able to buy land for warehouses, storage facilities, and other support infrastructure, as well as recruit overseas workers. There are 62 industrial estates around Thailand, with 12 of them being administered directly by the Industrial Estate Authority of Thailand (IEAT) and the rest operated jointly with private sector investors.

|

|

Advantages of setting up in a Thailand free zone

|

Relief from Import and Internal Taxes/Duties: Imported merchandise, removed into or manufactured in a Free Zone for industrial or commercial operations or any other operations involving economic growth and development, is not subject to import taxes and duties. This includes:

-

Machinery, equipment, and parts;

-

Foreign merchandise; and

-

Merchandise transferred from other Free Zones.

-

After review of investment project by the Board of Investments, such investment projects can benefit from tax incentives including i) up to eight years of corporate tax holidays and ii) reduced or waived custom duties on imports of raw material and equipment;

-

If the company secures BOI promotion status, the company can then secure additional tax benefits including: i) up to three additional years of corporate tax exemption and/or ii) reduced corporate tax rate of 10% during the following eight years;

-

If the company does not secure BOI promotion status, the special economic zone authority can decide to grant some or all of the tax benefits that such status would have granted, provided that the activities of the company i) are deemed of economic interest by the free zone authority and ii) matches with the targeted industries of the free zone.

-

In addition the imported merchandise removed into or manufactured in a Free Zone is also not subject to Value Added Tax (VAT), excise taxes, alcohol tax, including tax stamp and fees under the Alcohol Act, Tobacco Act, and Playing-Card Act. Additionally, a “ZERO” tax rate is applied to calculate VAT for domestic merchandise removed into a Free Zone, provided that such merchandise subject to export duty or exempted from export duty under the Customs Act.

|

|

Investment special economic zone incentives

|

Incentives that are given for BOI general activities located in the SEZs:

- Exemption on import duties on machinery.

- Three-year additional corporate income tax exemption, but not exceeding eight years in total.

- Projects with activities in Group A1* and Group A2** that have already been granted an eight-year corporate income tax exemption shall receive an additional incentive of a 50% reduction of corporate income tax for five years.

- Double deduction of the costs for transportation, electricity, and water supply for 10 years.

- 25% deduction of the costs of installation or construction of facilities in addition to the deduction of normal depreciation.

- Exemption of import duties on raw and essential materials used in manufacturing for export for five years.

- Non-tax incentives, such as permission to own land and employ foreign unskilled and skilled labor.

13 targeted industries:

- Agro-industry, fisheries, and related businesses

- Ceramic products manufacturing

- Textile, clothing, and leather manufacturing

- Furniture manufacturing

- Gems and jewellery manufacturing

- Medical devices manufacturing

- Automotive, machinery, and parts manufacturing

- Electronics and electrical appliances manufacturing

- Plastics manufacturing

- Pharmaceuticals manufacturing

- Logistic businesses

- Industrial zones or industrial estates

- Businesses that support tourism

Incentives that the 13 targeted industries are entitled to are:

- Exemption of import duties on machinery

- Corporate income tax exemption for up to eight years

- Additional 50% corporate income tax exemption for five years

- Double deduction of the costs for transportation, electricity, and water supply for 10 years

- 25% deduction of the costs of installation or construction of facilities in addition to the deduction of normal depreciation

- Exemption of import duties on raw and essential materials used in manufacturing for export for five years

- Non-tax incentives, such as permission to own land and employ foreign unskilled and skilled labor

|

|

Distribution

|

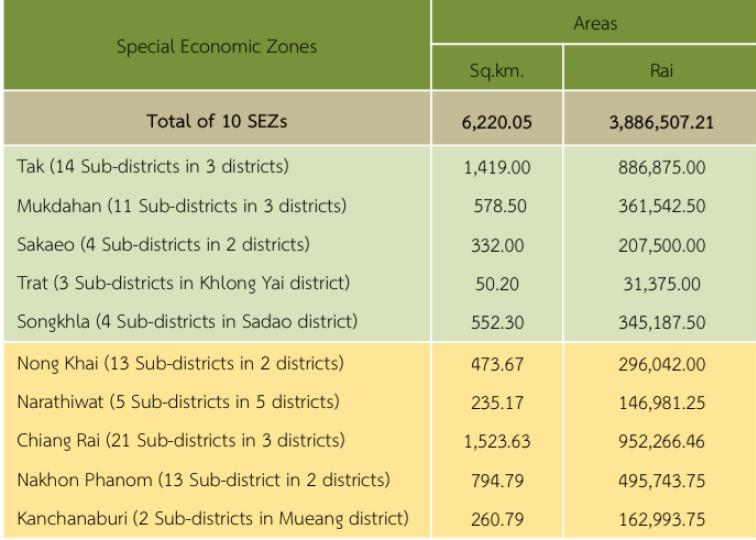

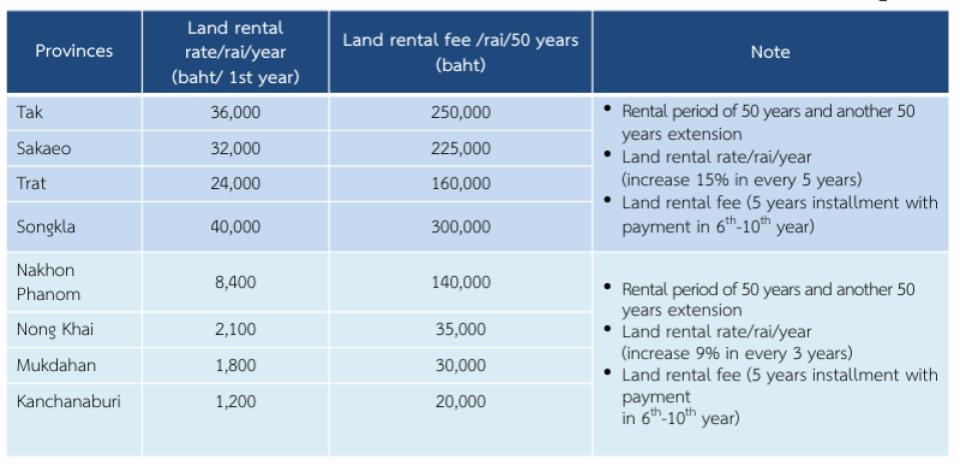

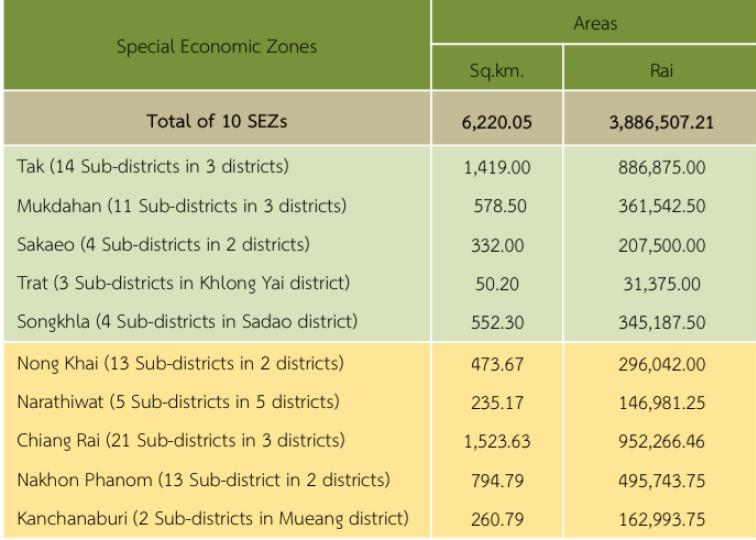

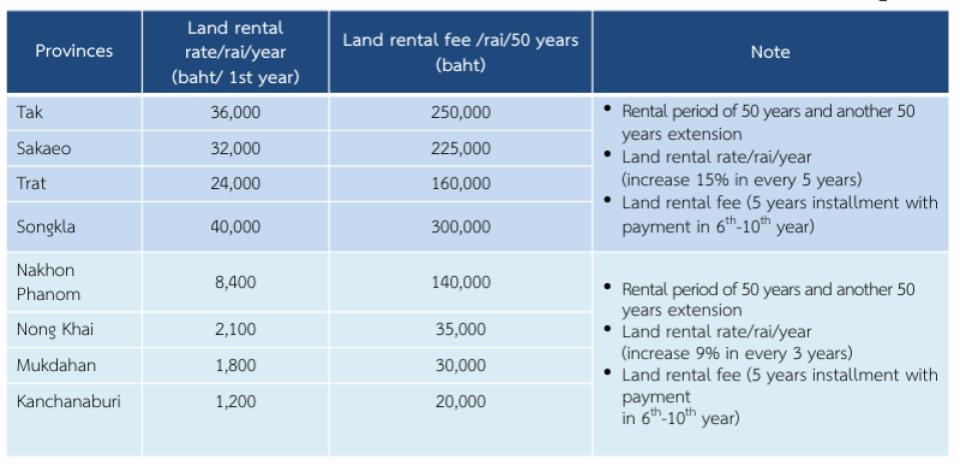

-

There are ten SEZs around Thailand. These are located in the provinces of: Chiang Rai, Narathiwat, Tak, Nong Khai, Trat, Kanchanaburi, Mukdahan, Songkhla, Sa Kaeo, Nakhon Phanom

-

There are 62 industrial estates around Thailand, with 12 of them being administered directly by the Industrial Estate Authority of Thailand (IEAT) and the rest operated jointly with private sector investors.

|

In some countries like Vietnam, having a resident director is a legal requirement for entrepreneurs incorporating a new limited liability company.

The resident director must be a local citizen or a foreign national with a valid residency permit, possessing a local address and currently living in the country

How can Viettonkin Assist?

Our nominee services provide confidentiality and operational support for companies aiming to protect their identities and ensure compliance, particularly valuable for businesses entering new geographic markets. Through the services, a third-party entity will be appointed as a representative, allowing the actual owner’s identity to remain private. It can be very useful for businesses to maintain discretion or comply with local requirements without revealing ultimate ownership. The representatives we appoint are of the highest standards, with years of relevant experience, no criminal record and no conflicts of interest.

Services Provided

- Our nominee services include professional directors and shareholders, selected for their clear and trustworthy backgrounds at the client’s request. These representatives are legally appointed to act on behalf of clients in company operations, ensuring compliance and privacy.

- We meticulously draft contracts and security measures to safeguard the representation process, securing the client’s interests

- We also takes full responsibility for all representative activities related to the client's company, ensuring transparency and trust in all operations conducted on behalf of the client.

Setting up a money remittance business is complicated as it involves many complex procedures and tedious paperworks.

Viettonkin Consulting's expert consultants are equipped with extensive industry knowledge and practical experience to guide our clients through every step of establishing and managing a this business:

- Step 1: We will assist our clients with all necessary procedures and applications for registering a new company.

- Step 2: After registration, we will collaborate with banks on behalf of our clients for matters related to opening or closing accounts, updating account information, and facilitating money transfers.

- Step 3: We will develop and implement KYC/AWL/CTF Compliance Programe.

- Step 4: We will execute the necessary procedures to apply for a Money Service Business (MSB) license and pursue rapid approval.

- Step 5: We will provide full post-incorporation support such as Corporate Secretarial Services, Compliance Services, Administrative Services, Legal Services, Accounting & Tax Services, Linguistics Services and Human Resource Management.

For any other operation needs, please refer to our full list of services offered.

In a world of unpredictability and financial uncertainty, businesses are regularly presented with complex financial situations and decisions.

Some of these situations present valuable opportunities, such as acquisitions or expansions, while others require you to protect yourself in litigation matters or financial disputes. However, those demanding financial decisions and situations often require expertise outside the realm of businesses' internal resources - resources that may already be stretched thin.

Viettonkin Corporate financial advisory team specializes in helping organizations manage major transitions and accounting issues, while mitigating threats that can pose significant risks. We apply our professional experience, competencies and methodologies to navigate complex corporate financial situations smoothly and with minimal disruption to the organization. Our deep knowledge of the corporate financial landscape and our experience in a variety of industries allow us to provide objective advice for your complex challenges.

Our services include:

- Divestitures

- Capital Services

- Project Finance

- Trade Finance

- Market Entry Strategy

- Go-To Market Strategy

Corporate Banking Services provide essential financial solutions to support businesses of all sizes in addressing regulatory and customer demands, navigating new market entrants, and competing in globalization.

These services include a range of offerings such as

- Account management

- Cash flow optimization

- Working capital financing

- Trade finance

- Foreign exchange

At Viettonkin Consulting, we assist clients in leveraging them effectively, collaborating closely with them to develop strategies that strengthen their financial foundation and foster growth in dynamic markets. For example:

- We will collaborate with banks on behalf of our clients for matters related to opening or closing accounts, updating account information, and facilitating money transfers.

- We assist clients in navigating the payments changes while implementing the transformation effectively

- We analyze customer purchasing needs and behaviors to create innovative solutions adjusted to their preferences.

- Leveraging our extensive experience in complex program delivery and technology integration by implementing significant changes to core banking systems.

Let Viettonkin Solve your Banking Problems

Problem: Vietnam's banking regulations can be intricate and frequently updated.

Solution: Viettonkin will provide up-to-date information and guidance on compliance.

Problem: Opening a bank account in Vietnam can be a lengthy and cumbersome process, especially for foreign entrepreneurs.

Solution: Viettonkin can streamline the process by liaising with banks and preparing the necessary documentation.

Problem: Some banks may be hesitant to provide finance for companies who are weak in their application.

Solution: Viettonkin will guide the company to craft high-quality documents which will increase the chances of successful application, such as a detailed business plan, feasibility study and project strength and weaknesses analysis (SWOT Analysis).

Problem: Apart from the major branches of the major local brands, most staff, including customer service, do not speak English well, which will make it difficult to establish high-level discussions.

Solution: Viettonkin provides linguistic services to help bridge the language barrier.

Problem: Corruption has been a real issue in Vietnam's banking sector for many years and investors might be hestitant to place their funds into local banks.

Solution: The Vietnam government has greatly enhanced their efforts to combat corruption in recent years. The nation also has the state-run Deposit Insurance of Vietnam (DIV), a financial institution that protects the rights of depositors and the stability of the banking system. As of June 30, 2024, the DIV protected depositors at 1,278 institutions nationwide, including 96 commercial banks and foreign bank branches, 1,177 people’s credit funds, one cooperative bank, and four microfinance institutions. Opening a bank account in local banks is beneficial as it has lower costs and requires less complex regulations. However, if clients are still hesitant, we can assist in opening bank accounts in international banks as well.

Viettonkin Consulting offers guidance in financial, tax, legal, and management areas to help businesses tackle complex challenges, streamline operations, and reach strategic goals.

We enable informed decision-making, and improve business efficiency to optimize cash-flow of the company.

-

Cash Flow Analysis and Forecasting

Service: In-depth analysis of existing cash flow patterns and reliable forecasting to estimate future cash requirements.

Benefit: Assists businesses in determining the timing of cash shortages and enables them to make necessary plans.

-

Working Capital Management

Service: Optimization of working capital components, including inventory, receivables, and payables.

Benefit: Ensures efficient use of resources and improves liquidity.

-

Debt Restructuring and Management

Service: Analysis and restructuring of current debt to minimize interest costs and improve repayment terms.

Benefit: Reduces financial burden and enhances cash flow.

-

Expense Reduction Strategies

Service: The service provides identification and implementation of cost-cutting measures, ensuring no compromise on quality or performance.

Benefit: Frees cash for other vital business needs.

-

Revenue Enhancement Strategies

Service: Formulate strategies to increase sales and enhance revenue streams.

Benefit: Influx of overall cash is increased.

-

Tax Planning and Optimization

Service: Formulate strategies to minimize tax liabilities and maximize tax benefits legally.

Benefit: Liberates more money for operations.

-

Banking and Financing Solutions:

Service: Assistance with loans, lines of credit, and other types of financing.

Benefit: Provides additional cash flow sources to support business operations.

-

Risk Management and Contingency Planning:

Service: Identification of potential financial risks including variable costs and development of contingency plans.

Benefit: Ensures the business is prepared for unexpected cash flow disruptions.

-

Human Resouce Optimization

Service: Maximise staff productivity and enhance working skills. Search for high-quality outsourcing if necessary.

With over 15 years of experience working with foreign partners, we are proud to have helped many large customers and partners eliminate all language burdens and become successful overseas.

Our cultural and linguistic solutions not only aim to aid our clients communicate effectively with their external stakeholders, but also faciliates strong internal connection across staff of diverse backgrounds, and nurture outstanding employee experience for their entities.

Additionally, our global marketing strategies optimize clients' marketing and sales strategy to drive profitable growth by drawing together insights from their customers, markets, business environments and internal organization.

Viettonkin assists business in creating unique and tailored marketing & sales strategy, right down to individual products, programs and customers segments. Our services include:

Localization

Localization is such an important step for a company to expand its business in a foreign market and communicate with the global workforce. As a result, Viettonkin provides localization services with a view to assisting clients' teams in conveying the natural content to international businesses:

-

Website localization: Websites are a platform where a company offers products and connects with customers, hence a professional website will bring a great customer’s experience in the digital environment. Website localization is not just the translation of texts. The process includes tailoring the language and designing responsive websites to attract customers.

-

Training materials: Training programs nowadays are not only delivered by paper manuals but also presented in the form of computer-based training sessions, web-based training, video presentations. As a result, training material localization service requires the involvement of translators, editors, desktop publishers, multimedia specialists, voice talents, producers and so forth. Viettonkin provides the entire package of training material localization.

Copywriting

Effective copywriting tells a story. Several of Google’s latest updates have had a strong focus on effective, user-friendly copy that helps answer searchers questions. At first glance it seems to be an easy task, just only a few words, but in fact it requires understanding the readers ‘psychology so that copywriters can stimulate customers’ interest in the product.

Additionally, clients also have to ensure SEO that makes it easy for Google to track that article. Viettonkin knows not only how to write – and write well – but also write in a way that serves both people and algorithms:

-

We create a content marketing strategy that aligns with your core values and your audiences’ wants, needs, and preferred ways of consuming content.

-

We produce effective content to use throughout your website, SEO-friendly descriptions to help your products rank, strong and succinct email campaigns, or blog posts that boost your visibility and credibility as an expert.

Other Marketing Strategies

-

Digital Marketing

-

Communication Strategy

-

Competitive Intelligence

-

Brand Consultation

Vietnam's Tax Rates

- Corporate Income Tax (CIT): 20% for most business types. 32%-50% for companies involved in petroleum and gas. 40%-50% for companies involved in rare materials.

- Value-Added Tax (VAT): 10% is the standard rate. 10% for essential goods and services. 5% for certain exported goods and services.

- Personal Income Tax (PIT): 5%-35% on a progressive sliding scale charged on global income for tax residents, 20% for non-tax residents charged only on their Vietnam-sourced income.

- Withholding Tax: 0% on dividends, interests, and royalties paid to resident companies, but 5% for resident individuals. 0%, 5%, and 10% on dividends, interests, and royalties paid to non-resident companies respectively, but all are 5% for non-resident individuals.

- Dividends paid by a Vietnamese company to its corporate shareholders: 0%

- Capital gains: 20%

Tax Filings

- The tax financial year in Vietnam starts from January 1 and ends on December 31. Enterprises can adopt an alternative tax financial year in certain circumstances, but it must be calculated and remitted on a quarterly basis.

- Foreign enterprises can continuously carry their tax losses forward for a maximum of five consecutive years after the loss-making year. The carryback of losses is not permitted, and there is no concept of group loss sharing or consolidated tax relief in the Vietnam tax system.

- Organizations and individuals producing and trading VAT taxable goods and services in Vietnam have to pay VAT.

- Enterprises declare and remit monthly VAT on the 20th of the following month. Meanwhile, for taxpayers whose turnover did not exceed 500 billion VND in the previous year, they can declare and pay quarterly VAT by the last day of the month following the end of the quarter.

- Language in the tax return and supporting documents for tax purposes must be in Vietnamese. Where the documents are in a foreign language, the taxpayers must briefly translate into Vietnamese and take self-responsibility for the accuracy of the translation.

- Quarterly provisional payment is required. If the provisional quarterly payments account for less than 80% of the total corporate income tax liability per annual return, the shortfall in excess of 20% is subject to late payment interest (0.03% per day). The deadline for annual filing is the last day of the third month after the tax year end.

- Taxpayers will need to pay an extra 0.03% penalty per day of late payment, 20% for underreported amounts, and higher for evasion, with a maximum of 300%.

- Tax returns for submission must be in Vietnam dong.

- Audited financial statements are generally required (applicable to foreign-invested enterprises, listed enterprises, etc.). Other supporting documents shall be required when the tax authorities carry out a tax audit.

How Viettonkin Will Benefit You

- We help clients efficiently to fulfill your tax rights and obligations, ensuring their declaration and payment processes are convenient, transparent, effective with reasonable cost.

- We offer a guidance on legal compliance, risk minimization, and maximizing tax incentives to achieve the most favorable tax outcomes.

- We will handle transactions and communications with tax authorities to protect client rights and interests fully.

Whether you are currently recruiting, looking for advice on industry recruitment trends or simply want to source information on expected salary rates, we can help.

Viettonkin Consulting Recruitment specialising in the recruitment of permanent, contract and temporary positions on behalf of the world’s top companies.

We will deliver a fully comprehensive sourcing strategy that covers standard forms of sourcing as well as innovative solutions to ensure we are attracting the most suitable candidates in the market.

Step 1: Initial Consultation

We will start by having a comprehensive consultation with the client to understand their needs regarding hiring, the culture of the organization, and the specific requirements of the job. This includes meetings with key stakeholders to gain detailed information about the roles to be filled. Additionally, Viettonkin Consulting will study the current job market to understand the availability of talent, industry trends, and competitive salary benchmarks.

Step 2: Candidate Sourcing

Using our extensive professional network built over the years, we will search for high-quality candidates matching the qualifications and skills stated by the company.

Step 3: Screening and Shortlisting

Our team assists the client in reviewing resumes to spot the candidates that fit the requirements of the job. We conduct initial phone or video interviews to assess candidates' qualifications and experience. Where appropriate, skills assessments, personality tests, and other forms of assessment are administered to further determine the suitability of candidates.

Based on the initial screening, we will create a shortlist of the most promising candidates along with detailed profiles that include resumes, interview notes, and assessment results. Viettonkin Consulting will send across the shortlisted candidates to the clients for their review and response. We will also fix interviews between the client's hiring teams and the shortlisted candidates.

Step 4: Final Selection

We help our client make a final hiring decision through comparative analysis and recommendations from our assessments. Furthermore, we conduct negotiations of offers to make certain that the terms are acceptable both for the candidate and within your budget.

Step 5: Onboarding Support and Post-Hire Evaluation

We support the client in developing a comprehensive onboarding plan in order to make sure everything goes well with the new hire. We will also keep in close contact with the new employee and the client's team during the first months to resolve any issues they may have for successful integration.

Foreign Contractor Tax (FCT) in Vietnam

Distribution and supply of goods (raw materials, supply of goods, machinery and equipment) under Incoterms (International Commercial Terms) and/or attached to services in Vietnam including domestic exports, except for goods processed under processing contracts with foreign entities.

VAT: Exempt

CIT: 1%

Services

VAT: 5%

CIT: 5%

Restaurant/Casino management services

VAT: 5%

CIT: 10%

Machinery and equipment leasing and insurance

VAT: 5%

CIT: 5%

Lease of aircraft, aircraft engines, aircraft spare parts and sea-going vessels without individual controllers

VAT: 5%

CIT: 2%

Construction and installation without supply of materials, machinery and equipment

VAT: 5%

CIT: 2%

Construction and installation with supply of materials, machinery and equipment

VAT: 3%

CIT: 2%

Production, transportation and service with supply of goods

VAT: 3%

CIT: 2%

Transfer of securities, certificates of deposit, ceding reinsurance abroad, reinsurance commissions

VAT: Exempt

CIT: 0.1%

Financial Derivatives

VAT: Exempt

CIT: 2%

Interest

VAT: Exempt

CIT: 5%

Royalties

VAT: Exempt or 5% (Computer software, technology transfer, and intellectual property rights transfer (including copyrights and industrial properties) are exempted)

CIT: 10%

Others

VAT: 2%

CIT: 2%

DTAA

Vietnam has signed 80 Double Tax Avoidance Agreements (DTAAs) as of 2024, though some are not in effect as of yet. The DTAAs are critical in preventing businesses and foreign investors from being double-taxed on their income, which frees up cash for other important uses. The following are the agreed taxes for Dividends, Interests and Royalties of Vietnam with other ASEAN countries.

Non-Treaty

Dividends | Interests | Royalties:

Resident Companies - 0%

Resident Individuals - 5%

Non-resident Companies - 0% | 5% | 10%

Non-resident Individuals - 5%

Indonesia

Dividends - 15%

Interests - 15%

Royalties - 15%

Thailand

Dividends - 15%

Interests - 10%/15%

Royalties - 15%

Singapore

Dividends - 5%/7%/12.5%

Interests - 10%

Royalties - 5%/10%

Interest earned by certain government bodies is exempt from withholding tax.

If the limits set by the DTAA are higher than the present withholding rates under domestic law, or if relevant tax obligations included in the DTAA do not exist in Vietnam, the domestic rates will apply.

In Vietnam, DTAAs impact both corporate and personal income taxes.

ASEAN Corporate Tax Rates in 2024:

- Brunei Darussalam - 18.5%

- Cambodia - 20%

- Indonesia - 22%

- Lao PDR - 20%

- Malaysia - 24%

- Myanmar - 22%

- Philippines - 25%

- Singapore - 17%

- Thailand - 20%

- Timor-Leste - 10%

- Vietnam - 20%

In order to work in Vietnam, it is legally required for foreign investors and their employees to possess Employment Visas.

Viettonkin Consulting will assist clients with determining the appropriate visas to apply for and support them throughout the tedious application process to increase the chances of successfuly applications.

Vietnam Employment Visas in 2024:

LD Visa

Foreign employees must obtain an LD visa, or work permit, valid for up to 2 years. To be eligible for a work permit, the applicant must comply with the following conditions:

- At least 18 years of age

- In good health

- A manager, executive director, or expert with relevant qualifications. Different roles have different requirements.

- Clean criminal record

- A visa that is granted by a competent authority of Vietnam unless otherwise prescribed by laws.

The employer can submit the application on behalf of the employee. Required documents include an application form, proof of legal status, investment certification, and a copy of the business license.

DT Visa

There are 4 types of DT Visas, also known as Investor Visa:

- DT1 - Total investment capital over VND 100 billion (3.92 million USD), or for investment into ‘prioritized’ areas as determined by the government. Valid for 5 years.

- DT2 - Total investment capital between VND 50 billion (1.96 million USD) and VND 100 billion (3.92 million USD), or for investment into ‘encouraged’ areas as determined by the government. Valid for 5 years.

- DT3 - Total investment capital between VND 3 billion (118,000 USD) and VND 50 billion (1.96 million USD). Valid for 3 years.

- DT4 - Total investment capital less than VND 3 billion (118,000 USD). Valid for 1 year.

Required documents include an application form, proof of legal status, investment certification, and a copy of the business license.

DN Visa

Entrepreneurs can apply for a 3-month single or multiple entry visa for short-term business visits. There are two types of DN Visa:

- DN1 – Foreigners who work with other businesses and organizations with legal status

- DN2 - Foreigners who enter to offer services, establish a commercial presence or perform other activities according to Vietnam's international agreements.

Documents required include application forms, flight itinerary, and an invitation letter from a Vietnamese counterpart.

There are numerous other types of Visa issued by the Vietnamese government for specific sectors. Viettonkin Consulting can assist in applying for the appropriate visas that the clients require.

Human resource is an invaluable asset of any organizations, playing the determinant role in leading the business to achieve success and conquer new heights. Mismanagement of workforce will inevitably result in business failures.

Fully grasping the vitality of a productive, thriving workforce in achieving any corporate goals, Viettonkin Manpower, with our local expertise combined with global FDI intelligence, offers workforce solutions - process, system, policies, technology - to help our clients successfully build and manage a strong, efficient, innovative business team. Furthermore, we devote our efforts to serve newly established FDI clients transfer smoothly into a new environment, while assisting domestic firms in expanding abroad and transforming the way they do business following an international standard and mindset.

Mobility

- Support our clients with applying for approving of labor demand, applying for Work Permit/Work Permit Exemption, VISA, health check, police clearance certificate

- Advise clients on positions/titles and conditions for applying for Work Permit, Work Permit Exemption pursuant to Vietnamese Law to ensure compliance with the other relevant regulations

HR Consultancy

- Labor disputes and problems:

-

Define a clear framework to handle disputes and subsequent steps for resolution on the basis of minimizing costs for parties involved

-

Identify potential labor issues and work on preventative measures to avoid escalation of issues

- Legal updates: Providing legal updates with regards to HR & Labour matters in respective countries.

- HR consultant: Consultancy for clients about the contents related to labor laws in businesses and solutions for circumstances in terms of labor.

HR Regulatory and Compliance

- Support our clients with labour regulation and procedures, employment contract drafting

- Consult on compensation & benefit (C&B)

- Advise on labor disputes and problems

- Assit in HR compliance report

Payroll Administration

- Support our clients with labour regulation and procedures, employment contract drafting

- Consult on compensation & benefit (C&B)

- Advise on labor disputes and problems

- Assit in HR compliance report

Recruitment

- Support our clients' recruiting strategies to attract the best talent

- Offer recuitment service in a wide variety of fields

- Help clients seek the most suitable candidates among a vast talent pool in the shortest time

Nominee Service

- Our nominee services include professional directors and shareholders, selected for their clear and trustworthy backgrounds at the client’s request. These representatives are legally appointed to act on behalf of clients in company operations, ensuring compliance and privacy.

- We meticulously draft contracts and security measures to safeguard the representation process, securing the client’s interests.

- We also takes full responsibility for all representative activities related to the client's company, ensuring transparency and trust in all operations conducted on behalf of the client.

Finding the right office space is crucial for the success of any business, whether it’s a startup or a large corporation.

Viettonkin Consulting helps in laying the foundations of our clients' business with office finding services.

Step 1: Initial Consultation and Needs Assessment

Viettonkin Consulting will meet with clients to understand their requirements regarding business needs, budget, preferred locations, and any other special requirements for office space.

Step 2: Market Research

We will conduct extensive market research to identify office spaces matching our clients' criteria. Once the research is compiled, a shortlist of properties is compiled for selection. This shortlist will include various options in location and building type for the client to choose from. Clients would also be able to choose the type of office they prefer - virtual, shared or permanent.

Step 3: Property Tours and Evaluation

Viettonkin Consulting will guide the clients through the shortlisted properties, where they can see if the space would work in person.

Step 4: Negotiation of Lease Agreement

We will aggressively negotiate with the landlord to obtain optimal lease terms and rental rates. The lease will be reviewed by our legal experts to ensure it is fair and protects the interests of the client.

Step 5: Space Planning and Design

Once the property is selected, the Viettonkin Consulting will aid in space planning to optimize such for functionality and efficiency. This could include working with architects and interior designers.

Step 6: Move-In Coordination

We will develop a detailed move-in plan for a seamless transition into the new office space-from movers to IT setup to facilities operational on the move-in date.

Step 7: Additional Services

On-ground support beyond the move is provided by us to resolve any issue that arises and to ensure full settlement of the clients in their new office space.

For businesses that are growing over time, we will also provide relevant advice on planning for further expansion and if an expansion is decided, we will restart this whole process with the clients once more

Intellectual Property (IP) refers to creations like inventions, designs, brand names, and artistic works that are legally protected to give creators exclusive rights.

In today’s competitive market, IP is equally important for companies seeking to stand out with a unique identity. Registering trademarks, for instance, is essential to establishing brand ownership. It ensures that, in cases of infringement, the law protects the business’s exclusive rights, helping safeguard brand identity and maintain market trust.

At Viettonkin Consulting, we can help our clients with these key IP types:

- Trademark Registration: Trademarks are among a company’s most valuable intangible assets. Registering a trademark is essential for products and services to enter the market confidently, laying the groundwork for asset growth and brand recognition.

- Trademark Renewals: Viettonkin guides you through the entire trademark renewal process, ensuring compliance with current legal requirements.

- Copyright: Protect original works of authorship and prevent others from copying, distributing, or publicly displaying the work without permission, generally lasting the creator’s lifetime plus 70 years.

- Patent: Protect inventions, granting exclusive rights to make, use, and sell an invention for a set period (usually 20 years).

Global Company Registration

We provide a full-service package to help you navigate local regulations and compliances and expand your business internationally with ease.

- Incorporation

- Corporate Secretarial Services

- Compliance Services

- Corporate Banking Services

- Nominee Services

- Administrative Services

Legal Services

We provide end-to-end legal solutions and advisory services for doing business in a new market.

- Corporate Law

- Labour Law

- Mergers & Acquisitions (M&A)

- Dispute Resolution

- Intellectual Property

- Tax Litigation

Accounting and Tax

We ensure full compliance and provide updated reports on fast-changing accounting and tax service standards.

- Tax Compliance

- Advisory Service

- Accounting and Bookkeeping

- International Transactions

Human Resource Management

We help you to build world-class teams and drive value for your business.

- Mobility

- HR Consultancy

- HR Regulatory and Compliance

- Payroll Administration

- Recruitment

Linguistic Services

We eliminate all language burdens and help you expand your presence locally.

- Localization

- Interpretation

- Copywriting

- Translation

- Transcreation

Market Readiness Assessment

We provide you with a comprehensive and thorough package for the market entry of a business venture.

- Pre-Feasibility Study

- Feasibility Study

- Market Research

- Business Matching

- Business Travel

- Business Development Consulting

Audit & Assurance

We help you monitor regulatory responsibilities and enhance your investor confidence.

- Auditing Services

- Assurance Services

- Risk Assurance

- Valuation Services

- Transfer Pricing

- Internal Audit

- Corporate Governance

- Due Diligence

- Forensic

- Financial Statement Audit

Marketing & Sales

We help you to transform your brand and bring you closer to your customers in this disruptive landscape.

- Strategy Consulting

- Digital Marketing

- Experience and Design

- Communication Strategy

- Competitive Intelligence

- Brand Consultation

IT Services

We aim to answer your business problems with IT solutions.

- Digital Transformation

- Technical Services

Merger & Acquisitions

We help you capture maximum value from corporate acquisition and mitigate both implicit and explicit risks.

- Strategy and Readiness

- Due Diligence

- Valuation

- Pre-Closing

- Post-Closing

Trade & Procurement Consulting

We provide you with solutions your procurement team needs to implement a great supply chain strategy in your sourcing processes.

- Trade Consulting

- Trade Brokerage

- Import & Export Compliance Consulting

- Procurement Sourcing

- Trade Consulting

Strategy & Corporate Finance

We help you manage major transitions and accounting issues while mitigating threats that can pose significant risks.

- Divestitures

- Capital Services

- Project Finance

- Trade Finance

- Market Entry Strategy

- Go-To Market Strategy

Tips for successfully investing in Vietnam:

1. Understand the Market

Over the past decade, Vietnam has experienced solid economic growth on the back of manufacturing, exports, and FDI. Investors should do thorough market research to understand the opportunities and risks in their sector of choice before executing investment. They should also conduct risk assessments and devise ways to mitigate them.

2. Regulatory Environment

Investors should familiarize themselves with the legal and regulatory environment in Vietnam to ensure full compliance. Make sure to follow all the local regulations, including tax laws, labor laws, and environmental regulations. However, do prepare for lengthy application processes and delays in obtaining offical documents and permits.

3. Leverage Local Expertise

Engage professional partners like local legal, financial, and business consultants such as Viettonkin Consulting to get through the complexities of the Vietnamese market. Hire local management and staff who understand the dynamics of the market and the cultural nuances.

4. Networking and Relationships

Foster good relationships with local businesses and industry associations. Success relies heavily on building personal relationships and trust with local business people. Respect for authority and seniority is significant, so ensure senior representatives from your company attend important meetings.

Initial meetings are typically for getting acquainted; business negotiations may not begin immediately. It is also advisable to sign contracts with reliable suppliers when setting up business.

5. Monitor Economic and Political Developments

Keep up to date with economic policies and government initiatives that may affect your investment. Be prepared to adjust investment strategies to any changes in the business environment.

Interesting facts about Vietnam:

- The largest cave in the world, Son Doong Cave is in Vietnam.

- The Tet Nguyen Dan, or Vietnamese New Year, is the most important festival in Vietnam, celebrated according to the Lunar Calendar, typically in February.

- Despite being a tropical country, Vietnam experiences snowfall in the northern town of Sa Pa, which sits over 1,600 meters above sea level.

- The surname "Nguyen" is the most common in Vietnam, with over 36 million people having this last name. It accounts for nearly 40% of Vietnamese surnames.

- Vietnam is home to 54 different ethnic groups, with the Kinh (Viet) group being the majority. Other significant groups include the Tay, Thai, H’mong, and Khmer.

Important facts about Vietnam:

- Vietnam extends about 1,650 km from north to south and is about 50 km wide at its narrowest part. It is bordered by China, the South China Sea, the Gulf of Thailand (Gulf of Siam), Cambodia and Laos.

- Vietnam has a population of 101,294,692 and is the 16th most populous country in the world.

- Vietnam is the world's second-largest coffee exporter, behind only Brazil.

- Vietnam is the world's third-largest textile and garments exporter in the world, behind China and Bangladesh.

- The literacy rate of Vietnam is very high at ~96%.

Question: Do I have to be present in Vietnam to incorporate my business?

Answer: No, Viettonkin Consulting will help you with the procedures required here. However, there might be a chance that you might need to come to Vietnam, especially for opening of bank accounts. That being said, we will liaise with the banks and do our utmost to ensure that does not happen. On the occassion that it does, we will provide you with business travel arrangements.

Question: What is the minimum number of directors needed to set up a company in Vietnam?

Answer: At least one. We also offer resident director services for investors who are unable to live in Vietnam.

Question: Are there any restrictions on foreign ownership in Vietnam?

Answer: Vietnam allows for 100% foreign ownership for businesses in most sectors.

Question: What is the minimum capital requirement for setting up a business in Vietnam?

Answer: It depends on the business entity. Generally, there is no minimum capital, but it is recommended to have at least USD 10,000.

Question: What is the shortest amount of time I need to establish a business in Vietnam?

Answer: It depends on the entity as well as the duration for obtaining the relevant certificates and permits. However, it would take a minimum of 1 month, and generally, it would take 3 months.

Question: Can I hire foreign employees to work for my company?

Answer: Yes, but they must possess the appropriate employment visas.

-

Providing consultation for two investors from China on legal process of establishing a Joint Venture company and setting up their factory in Vietnam. We offered assistance with compliance issues in construction and manufacturing areas; procedures regarding charted capital and vertical business expansion. With our Retainership service, our client's requests were successfully fulfilled, as contents of the Investment Registration Certificate and the Business Registration Certificate were adjusted to their expectations.

-

Advising for a Canadian corporation on establishing a legal entity in Vietnam. The consultation expanded to factory rental, staff recruitment as well as accounting and tax procedures for an aircraft components production line. We provided a range of feasible options for our clients and acted as a legal representative to support them in drafting, reviewing contracts, recruiting personnel, dealing with accounting and tax requirements.

-

Consult for a Singaporean investor in setting up a medical firm in Hanoi, Vietnam. We helped our client to speed up the process and provided solutions on compliance procedures. With a profound understanding and long-standing experience of local jurisdiction, we served to help our client acquire a local business and ensure smooth transition of contracts, human resources, tax and internal processes.

-

Provide services for a Hong Kong company to set up its branch in Vietnam in the field of logistics. Our client faced the challenge of doing a joint venture with a business partner in Vietnam. Viettonkin provided outstanding Nominee Shareholder service and carried out company registration procedure related to investment registration certificate, business registration certificate and bank account opening.

-

Consulting for a Malaysian Marketing company to set up their business in Vietnam. We provided our client with Nominee shareholder service to meet the requirements of registered industry and procedure pertaining to Certificate of Business and bank account registration.